Protect Your Pension

The bedrock principle guiding pension fund management is fiduciary duty: the legal and ethical obligation to act solely in the best financial interests of their beneficiaries. This duty demands prudence, loyalty, and diligent risk management. In an era defined by accelerating climate change and a global transition towards a low-carbon economy, the continued investment in fossil fuel assets increasingly conflicts with this core responsibility. Far from being a purely ethical stance, divestment from fossil fuels is rapidly becoming a financial imperative, a cornerstone of sound fiduciary care.

The primary financial threat emerging from the climate transition is that of stranded assets. These are defined as assets that suffer unanticipated or premature write-downs, devaluations, or conversion to liabilities. For the fossil fuel industry, stranding can be triggered by a confluence of factors: stringent new government regulations limiting carbon emissions, shifts in market demand driven by the plummeting costs and increasing adoption of renewable energy, and even growing legal action against high emitters. Coal-fired power plants, for instance, are identified as particularly exposed to this risk, potentially needing to retire decades earlier than planned to meet international climate goals.

The financial exposure for UK pension savers is alarmingly significant. Reports indicate that the UK economy is disproportionately vulnerable to stranded fossil fuel assets, with potential losses for UK pension savers reaching tens of billions of pounds by 2040. More precisely, research from the UK Sustainable Investment and Finance Association (UKSIF) shows that UK pension funds face a £15.2 billion risk from stranded fossil fuel assets by 2040. The UK’s broader total economic exposure to stranded asset risk is calculated at a staggering £113 billion by 2040. These are not speculative future losses, but a clear, quantifiable financial risk that asset owners and managers are increasingly neglecting at their peril.

Against this backdrop, the concept of fiduciary duty takes on new urgency. If pension funds are obligated to preserve and grow the capital entrusted to them, then continuing to hold assets that are demonstrably at risk of premature devaluation directly contradicts this duty. Legal experts, such as ClientEarth, have actively warned that continued financing of new fossil fuel projects, like the proposed Cumbria coal mine, could leave financial firms in breach of their legal duties to investors. The argument is straightforward: firms owe an explanation to their investors on how ongoing support for such projects aligns with their beneficiaries’ best interests, which they are legally bound to protect. The rising scrutiny from investors regarding metallurgical coal investments further underscores this growing awareness of risk within the market itself.

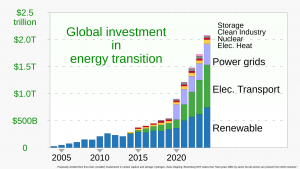

Moreover, the international policy landscape reinforces the inevitability of this transition. Authoritative bodies like the International Energy Agency (IEA) have unequivocally stated that “no new oil and gas fields approved for development are needed” on the path to net-zero, a stance echoed by the UK’s own Climate Change Committee (CCC) regarding new domestic fossil fuel fields. Continued investment in fossil fuels in defiance of these expert assessments represents not only an environmental gamble but a profound financial misjudgment, locking pension funds into declining industries and exposing them to the risk of “stranded assets” worth billions of pounds.

In this context, the recently introduced Pension Schemes Bill presents a golden opportunity for the UK’s pension landscape. This landmark legislation aims to deliver bigger pension pots and better value for millions of savers, ultimately benefiting up to 20 million workers across the UK. Crucially, the Bill provides a pathway for a greener future by enabling the consolidation of Local Government Pension Scheme (LGPS) assets into larger pools that can invest significantly in local infrastructure, housing, and clean energy.

In particular, the Tyne and Wear Pension Fund (TWPF), which serves over 165,000 members across the region, is already a significant investor in climate-positive assets and aligns with national net-zero targets. This strategic shift, actively championed by various organizations and campaigners, highlights the potential for UK pensions to unlock trillions of pounds for sustainable growth, aligning financial security with environmental responsibility. It’s a chance to protect and enhance the financial future for pensioners by investing in the industries of tomorrow. As Richard Curtis (Love Actually director and founder of Comic Relief) stated, ‘Greener, fairer pensions are our superpower to protect the future for all generations. We need our leaders to put British savers and climate safety at the heart of the pension reform. There’s no point inheriting a pension in a world on fire.’

In conclusion, for pension funds, the decision to divest from fossil fuels is no longer a fringe ethical consideration but a central component of prudent financial management. Their fiduciary duty demands a proactive approach to risk mitigation. By moving away from investments in an increasingly volatile and devaluing fossil fuel sector and instead reallocating capital towards sustainable, low-carbon alternatives like renewable energy, pension funds can not only safeguard their beneficiaries’ long-term financial health but also align their portfolios with the inevitable direction of global economic and environmental policy. This is about ensuring long-term prosperity and resilience, fulfilling their core mandate in a rapidly changing world.

Where next? Use the links below:

About: Our mission: From Awareness To Action

My Blog: Events and Commentary

Web of Power: Book 1 of a trilogy – Understanding Power

Grasp the Nettle: Book 2 of a trilogy – Embracing Power

Forward Futures: Book 3 of a trilogy – Using Power

Facebook: Our community space and new content information

Mailing List: Online Form

Bibliography

City of Westminster Pension Fund Carbon exposure through the investment portfolio. (n.d.). Retrieved from https://committees.westminster.gov.uk/documents/s35157/6b%20-%20Appendix%201%20-%20Carbon%20Exposure%20Report.pdf

UK pension funds face £15.2bn risk from stranded fossil fuel assets – Pensions Age Magazine. (2025, March 6). Retrieved from https://www.pensionsage.com/pa/UK-pension-funds-face-15-2bn-risk-from-stranded-fossil-fuel-assets.php

Stranded energy assets put UK on course for $141bn loss, says study. (2025, March 6). Energy Voice. Retrieved from https://www.energyvoice.com/renewables-energy-transition/567938/stranded-energy-assets-put-uk-on-course-for-141bn-loss-says-study/

UK pension funds face $19bn in stranded assets by 2040 | Netzeroinvestor. (2025, March 6). Retrieved from https://www.netzeroinvestor.net/news-and-views/uk-pension-funds-face-19bn-in-stranded-assets-by-2040

UK Economy Heading for $141 Billion Loss Caused by Stranded Fossil Fuel Assets, With Pension Funds on Track to Lose $19 Billion – UKSIF. (2025, March 6). Retrieved from https://uksif.org/stranding-press-release/

UK economy faces $141bn of stranded fossil fuel asset risks – Professional Pensions. (2025, March 6). Retrieved from https://www.professionalpensions.com/news/4410448/uk-economy-usd141bn-stranded-fossil-fuel-asset-risks

STRANDED ASSETS: FOSSIL FUELS – Environment Agency Pension Fund (EAPF). (n.d.). Retrieved from https://www.eapf.org.uk/~/media/document-libraries/eapf2/report-and-accounts-doc/eapf-stranded-assets-report.pdf?la=en&hash=A23091E00B001111F54F22B23A2AE7473D69FE8D